Times Square was hit by a flash mob of "homeless" Uncle Sams today, who were there giving the Naked Cowboy a run for his money, asking passerbys if they could spare some change —$12 trillion, to be exact.

Times Square was hit by a flash mob of "homeless" Uncle Sams today, who were there giving the Naked Cowboy a run for his money, asking passerbys if they could spare some change —$12 trillion, to be exact.No, that’s not a typo. It was a stunt by the Employment Policies Institute, part of their “Defeat the Debt” campaign to try to educate Americans about just how big the U.S. debt is a day before congress is scheduled to begin debate on raising the debt ceiling.

EPI is a nonprofit research organization that studies public-policy issues related to employment growth and the economy.

- Fed Posts Record Earnings From Fighting Financial Crisis Federal Reserve banks paid a record $46.1 billion to the US Treasury in 2009 as aggressive bond purchases and lending to fight the financial crisis swelled its net income by nearly 47 percent to a record $52.1 billion.

The Fed's payment to the Treasury represents an increase of $14.4 billion over its 2008 contribution and was the largest since the U.S. central bank was created in 1914.

- We remember Citi Sandy Weill -- who retired right before the R.E. bubble crash. As historical data and events prove, the Dodd (2007~) - "Senate Banking Committee" is one of the biggest contributors toward massive financial corruption and robbery of Americans and the nation. Greenspan, Bernanke, the banking committee, etc. led America into living hell just similar as a giant drug organization using lies and deception. Greenspan after bubbling up financial markets, repealed the Glass-Steagall act to create R.E. bubble robbing Americans as they knew that American savings were gone into financial markets. What was left is to rob Home Equities. We don't have 100% proof which God knows all the facts, but based on given facts, we can conclude.

|

H.R. 4173, the financial-reform legislation--The Fed global terrorism continues ~ using financial market bubble/crash as proven that in history - mentally, financially, and spiritually.

- Bernanke faces Senate woes

http://www.kelowna.com/2009/12/19/bernanke-faces-senate-woes/Ben Bernanke's close escape from the Senate banking committee sets him up for a record number of final "no" votes on his renomination as Federal Reserve chairman.

The Fed Bernanke hand straight to Treasury

The Senate Banking Committee repealed the "Glass-Steagall" act causing the trillions swindle bubble/burst scheme. The repeal happened to be strongly pushed by the Citi CEO Sandy Weill. When he saw the housing crash was starting, he resigned before the blame falls.

- 12.17.2009 Senate Banking Committee Votes 16-7 to Approve Ben Bernanke for Second Term as Fed Chairman

Senate Vote: The Senate Banking Committee Thursday is scheduled to vote on his renomination in a 9:30 a.m. hearing, a vote that is expected to pass before his confirmation goes to the full Senate in several weeks time.Bernanke is expected to be confirmed, but he has his critics, including Sen. Jim Bunning, (R-Ky.), who blasted Time's selection as a reward for failure. Some in Congress have complained about the Fed's approach to the financial bail outs and have called for curbs on the Fed's powers.

Sen. John McCain (R-Ariz.) said he is leaning against voting for the Fed chairman, and Sens. Bernie Sanders (I-Vt.) and Jeff Merkley, D-Ore. both say they are definitely voting against him.

http://www.cnbc.com/id/34456169- Some Senate Banking Members Oppose Bernanke

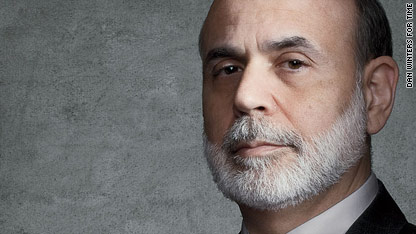

Federal Reserve Chairman Ben Bernanke, who helped steer the U.S. economy through its darkest days since the Great Depression, was named Time magazine's 2009 Person of the Year on Wednesday.

http://www.time.com/time/photogallery/0,29307,1947811_2013195,00.html

Federal Reserve Chairman Ben Bernanke sat down on Dec. 8, 2009 with TIME managing editor Richard Stengel, Time Inc. editor-in-chief John Huey, TIME assistant managing editor Michael Duffy, and TIME senior correspondent Michael Grunwald for a conversation on everything from the state of the economy to the contents of his wallet. Here is an extended, edited transcript of the interview.

http://money.cnn.com/galleries/2009/fortune/0912/gallery.dumbest_moments_decade.fortune/2.html

This explains a significant piece of puzzle to the entire scheme.

GREENSPAN: Jan 25, 2001: The Maestro's dubious debt warning

Just days after President George W. Bush took office, Fed chief Alan Greenspan admonished budgeteers about the dangers of -- get this -- too little federal debt.

"At zero debt, the continuing unified budget surpluses currently projected imply a major accumulation of private assets by the federal government," Greenspan told the Senate Budget Committee.

- Bombshell Eyewitness Revelations: Confirmed FBI Cover-Up Of Flight 253 Attack 1/3

http://www.youtube.com/watch?v=wM2yiohmPEI&NR=1 - 12-29-2009 Update - DUTCH-INDONESIAN LINK WITH ATTEMPTED Aircraft 'BOMBING'

http://www.youtube.com/watch?v=0xT4jUV1_KU - Alex Jones - Bombshell Eyewitness Revelations: Confirmed FBI Cover-Up Of Flight 253 Attack (3 of 3)

http://www.youtube.com/watch?v=51sWFJc0_6o - Russia Today: Underpants bomber a false flag says Webster Tarpley -

http://www.youtube.com/watch?v=faSIdHaaVPc - Kurt Haskell Returns to The Alex Jones Show 2/3:

Officials Admit Second Man Detained

http://www.youtube.com/watch?v=_2f_uSM5VXQ

Tokyo, Japan (CNN) -- Satoshi Miura crawled into his rented room, dropping his bag in the corner. It didn't take long to get settled -- home tonight is a capsule. The rooms are boxes in this capsule hotel about the size of a coffin.

http://www.cnn.com/2010/WORLD/asiapcf/01/07/japan.capsule.home/index.html

Have you moved your money yet?

http://www.huffingtonpost.com/2010/01/07/move-your-money-movement_n_415326.html

No comments:

Post a Comment